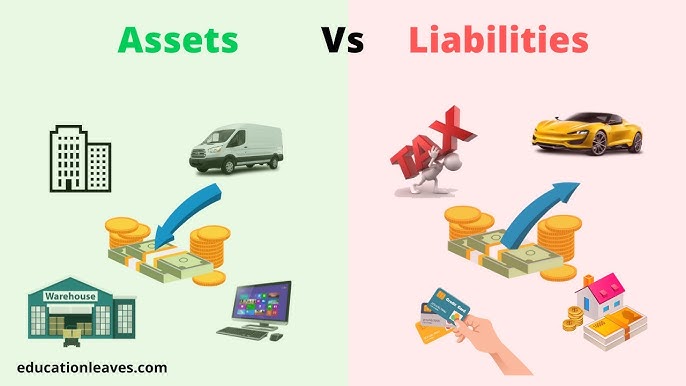

Understanding the difference between assets and liabilities is one of the most important concepts in personal finance and business finance. This knowledge helps individuals and organizations make better financial decisions, build wealth, and avoid unnecessary debt. Simply put, assets put money into your pocket, while liabilities take money out of your pocket.

This article clearly explains the difference between assets and liabilities, their types, examples, and why they matter for financial success.

What Are Assets?

Assets are things you own that have economic value and can generate income or increase in value over time.

Key Characteristics of Assets

Generate Income

Assets often produce cash flow, interest, or profits.

Increase Net Worth

They add value to your overall financial position.

Can Be Sold or Converted into Cash

Assets usually have resale or market value.

Types of Assets

Assets come in different forms depending on how they are used.

Tangible Assets

Physical Assets

These include items you can see and touch.

Examples:

- Real estate

- Land

- Machinery

- Gold

Intangible Assets

Non-Physical Assets

These have value but no physical form.

Examples:

- Patents

- Trademarks

- Copyrights

- Brand value

Financial Assets

Income-Generating Assets

These assets earn interest, dividends, or capital gains.

Examples:

- Stocks

- Bonds

- Mutual funds

- Savings accounts

What Are Liabilities?

Liabilities are financial obligations or debts that require you to pay money in the future.

Key Characteristics of Liabilities

Require Regular Payments

Liabilities often involve monthly or periodic payments.

Reduce Net Worth

They subtract from your overall financial value.

Carry Financial Risk

Interest and penalties increase the total cost over time.

Types of Liabilities

Liabilities are generally categorized based on duration and purpose.

Short-Term Liabilities

Due Within One Year

These require immediate or short-term repayment.

Examples:

- Utility bills

- Credit card balances

- Short-term loans

Long-Term Liabilities

Due Over Many Years

These usually involve larger amounts.

Examples:

- Home loans

- Car loans

- Student loans

Key Differences Between Assets and Liabilities

Cash Flow Impact

Assets

Assets generate income or appreciate in value.

Liabilities

Liabilities require ongoing payments and expenses.

Effect on Financial Health

Assets

Improve financial stability and wealth.

Liabilities

Increase financial burden and risk.

Role in Net Worth

Assets

Increase net worth.

Liabilities

Decrease net worth.

Assets vs Liabilities: Simple Comparison Table

| Feature | Assets | Liabilities |

|---|---|---|

| Definition | Things you own | Things you owe |

| Cash Flow | Brings money in | Takes money out |

| Net Worth Impact | Positive | Negative |

| Examples | Investments, property | Loans, credit cards |

Why Understanding Assets and Liabilities Is Important

This knowledge plays a major role in financial success.

Helps in Better Money Decisions

Smarter Spending

Understanding liabilities prevents unnecessary debt.

Investment Planning

Focus on acquiring income-generating assets.

Builds Long-Term Wealth

Financial Growth

More assets mean more financial security.

Reduced Debt Stress

Fewer liabilities lead to peace of mind.

Common Misconceptions About Assets and Liabilities

Is a House Always an Asset?

A house can be an asset if it generates income or appreciates significantly. However, if it only creates expenses, it may act like a liability in the short term.

Is a Car an Asset?

Cars usually lose value and require maintenance, so they are often considered liabilities rather than assets.

How to Increase Assets and Reduce Liabilities

Smart Financial Habits

Invest Regularly

Focus on assets that grow over time.

Pay Off High-Interest Debt

Reducing liabilities improves cash flow.

Balance Is Key

Strategic Borrowing

Some liabilities, like education loans, can help create future assets.

Conclusion

Understanding the difference between assets and liabilities is essential for building financial stability and long-term wealth. Assets help you grow financially by generating income or increasing in value, while liabilities reduce your wealth by requiring regular payments. By focusing on acquiring more assets and managing liabilities wisely, individuals can improve their net worth and achieve better financial control. Financial success is not just about how much you earn—it is about how well you manage assets and liabilities.

Frequently Asked Questions (FAQs)

1. What is the main difference between assets and liabilities?

Assets add value and generate income, while liabilities create expenses and debt.

2. Are all loans considered liabilities?

Yes, loans are liabilities because they require repayment with interest.

3. Can something be both an asset and a liability?

Yes, depending on how it is used, such as a house or business equipment.

4. Why are assets important for financial growth?

Assets help increase net worth and provide long-term financial security.

5. How can I improve my financial position?

Focus on building assets, reducing high-interest liabilities, and managing money wisely.